25+ Mortgage ratio calculator

Private mortgage insurance PMIprotects the mortgage lender if the borrower is unable to repay the loan. A mortgage is a legal instrument of the common law which is used to create a security interest in real property held by a lender as a security for a debt usually a mortgage loan.

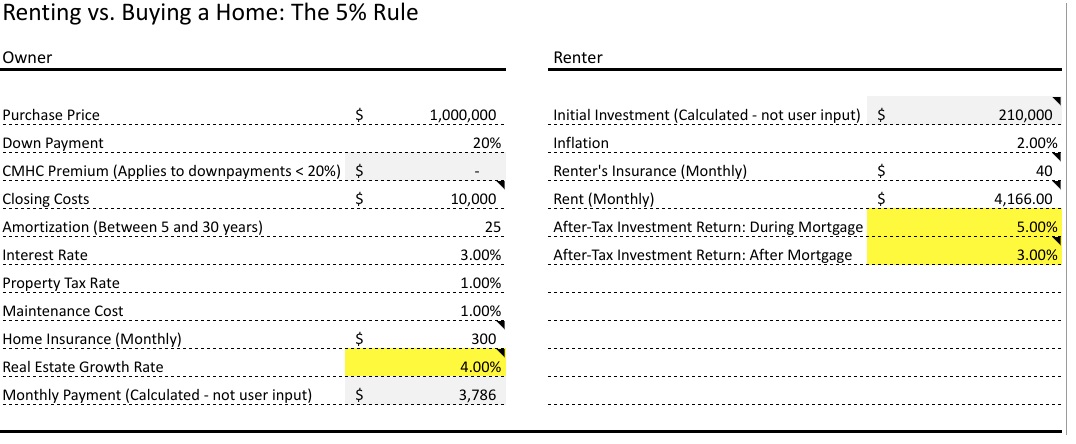

Rent Vs Buy Calculator The Devil S In The Details Toronto Realty Blog

Use our Alberta mortgage calculator to determine your monthly mortgage payment for your home purchase in Alberta.

. Mortgage Calculator excel spreadsheet is an advanced mortgage calculator with PMI taxes and insurance monthly and bi-weekly payments and multiple extra payments options to calculate your mortgage payments. The current best high-ratio fixed mortgage rate in Quebec is 424. 2021 2022 Mortgage Rate Housing Market Predictions Mortgage Rates.

After 8 years the fsagovuk redirects will be switched off on 1 Oct 2021 as part of decommissioning. The term ratio refers to the size of your mortgage loan amount as a percentage of your total purchase price. Mortgage default insurance is calculated as a percentage applied to your mortgage amount.

Contractors Lenders may use an annualised version of your day rate or an average of your net profits depending on the type of contractor you are. Use our free mortgage calculator to estimate your monthly mortgage payments. How To Calculate Your Front End Debt-To-Income Ratio DTI.

The loan to value ratio or LTV is the size of the loan against the value of the property. 2836 are historical mortgage industry standers which are. To estimate the cost of breaking your mortgage our mortgage penalty calculator is a useful tool.

For example if your current balance is 100000 and your homes market value is 400000 you have 25 percent equity in the home. Using a home equity loan can be a good choice if you can afford. A mortgage in itself is not a debt it is the lenders security for a debt.

By default this calculator uses a 28 front-end ratio housing expenses versus income a 36 back-end ratio monthly housing plus debt payments versus income though these are variables in the calculator which you can adjust to suit your needs the limits set by your lender. What to watch for with a loan to value ratio calculator. However note that 30-year FRM rates are generally higher by 025 to 1 than 15-year FRMs.

For example a 30-year fixed mortgage will have a lower monthly payment than a 15-year fixed but will require you to pay more interest over the life of the loan. Lifetime Mortgage Costs Over 25 Years. You may also look at the following articles to learn more Guide Retention.

PE Ratio 16548 1191. Enter an amount between 0 and 25. The higher rate and longer term results in more expensive.

In the UK and US 25 to 30 years is the usual maximum term although shorter periods such as 15-year mortgage loans are common. Ideal Debt-to-Income Ratio for Mortgages. We also provide you with PE Ratio Calculator with a downloadable excel template.

This ratio is commonly defined as the well-known debt-to-income ratio and is more widely used than the front-end ratio. The VA loan calculator provides 30-year fixed 15-year fixed and 5-year ARM loan programs. Fannie Mae chief economist Doug Duncan believes the 30-year fixed rate will be 28 through 2021 and reach 29 in 2022.

Monthly Mortgage Payment Amount Calculator. 25 years for mortgages with down payments under 20 or 35 years for. In the United States lenders use DTI to qualify home-buyers.

Of course the lower your debt-to-income ratio the better. Back end ratio looks at your non-mortgage debt percentage and it should be less than 36 percent if you are seeking a loan or line of credit. Read here for tips tricks and insights into home loans the property market and all things finance.

Hypothec is the corresponding term in civil law jurisdictions albeit with a wider sense as it also covers non-possessory lien. This mortgage calculator makes it easy to see how changes in the mortgage rate or the loan amount affect the income required for a loan. While 43 is the maximum debt-to-income ratio set by FHA guidelines for homebuyers you could benefit from having a lower ratio.

In the US the standard maximum limit for the back-end ratio is 36 on conventional home mortgage loans. Enter an amount between 0 and 25. With access to more than 30 lenders and thousands of different home loans we wont stop until weve found you the right home loan for your individual needs.

In the mortgage calculator above you can. Assuming you have a 20 down payment 80000 your total mortgage on a 400000 home would be 320000For a 30-year fixed mortgage with a 35 interest rate you would be looking at a 1437 monthly payment. Partners Providing you own 25 share or more of the limited liability partnership your share of average net profits over the last 2-3 years will be considered income for mortgage purposes.

The loan program you choose can affect the interest rate and total monthly payment amount. The comparison rate provided is based on a loan amount of 150000 and a term of 25 years. Specifically if the down payment is less than 20 of the propertys value the lender will normally require the borrower to purchase PMI until the loan-to-value ratio LTV reaches 80 or 78.

The maximum mortgage calculator will allow you to input your monthly obligations your monthly income to calculate the maximum monthly mortgage payment. The beginning most of. Outside of credit score lenders typically look at your debt-to-income ratio which compares your monthly debts including the prospective mortgage payment to.

Here we discuss its uses along with practical examples. Improve Your Credit Profile. Use this simple online mortgage calculator to easily estimate your monthly mortgage payment interest rates and taxes.

As a rule of thumb lenders are looking for a front ratio of 28 percent or less. Therefore a mortgage loan in which the purchaser has made a down payment of 20 has a loan to value ratio of 80. The Mortgage Bankers Asociations chief economist Mike Fratantoni believes the 30-year fixed rate will reach 33 in 2021 and 36 in 2022.

Account for interest rates and break down payments in an easy to use amortization schedule. When a buyer decides to have a down payment lesser than 20 the loan to value ratio is higher than 80. This has been a guide to the Price to Earning Ratio formula.

A mortgage with a down payment below 20 is known as a high-ratio mortgage mortgage. Which are known as high ratio mortgages. So for example if you were being offered a mortgage rate of 225 the lender might do a stress test to see if you could still afford payments at the qualifying rate of.

This Comparison Rate applies only to the example or. Some of the most considered factors involved in determining the mortgage you qualify for are your debt-to-income ratio your loan-to-value ratio. See how you can save money on interest in the long term and figure out what the best mortgage option is for you.

Depending on the type of loan you choose you must satisfy the required DTI ratio limits to secure a mortgage. The ideal debt-to-income ratio for aspiring homeowners is at or below 36. PE Ratio 1389x.

Please keep in mind that the exact cost and monthly payment for your mortgage will vary depending its length and terms. Your Mortgage Choice broker will handle your home loan for you from start to finish giving you the reassurance of expert home loan advice and ongoing support.

End Of Qe 4 Fed S Repos Drop Below Oct 2 Level T Bills Balloon Mbs Fall Total Assets Down To Dec 25 Level Wolf Street

Recession Watch This Labor Market Is Not There Yet Nor Are Consumers Wolf Street

Recession Watch This Labor Market Is Not There Yet Nor Are Consumers Wolf Street

How Interest Rates Can Impact Your Monthly Housing Payments Mortgage Loans Mortgage Calculator Reverse Mortgage

Recession Watch This Labor Market Is Not There Yet Nor Are Consumers Wolf Street

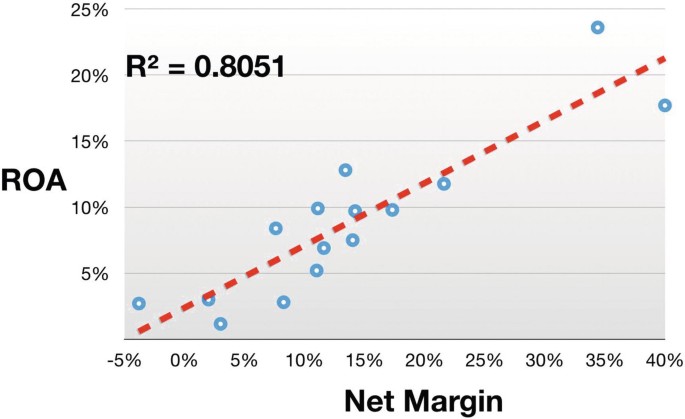

Valuation Ratios Springerlink

Recession Watch This Labor Market Is Not There Yet Nor Are Consumers Wolf Street

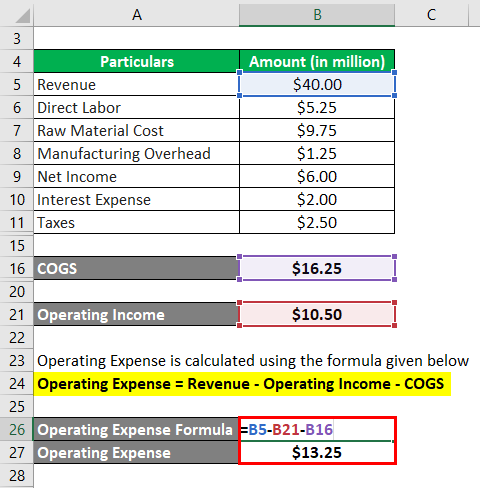

Operating Expense Formula Calculator Examples With Excel Template

Fixed Mortgage Rates Highest Since August Ratespy Com

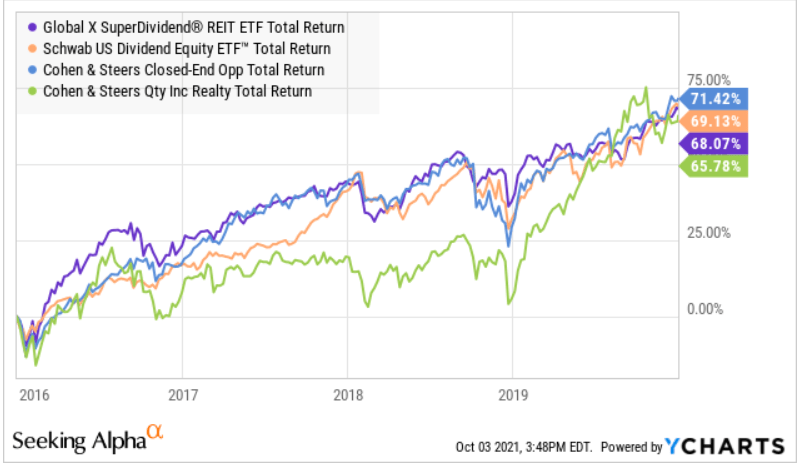

My Dividend Growth Portfolio Q3 Update 30 Holdings 11 Buys And 2 Sells Seeking Alpha

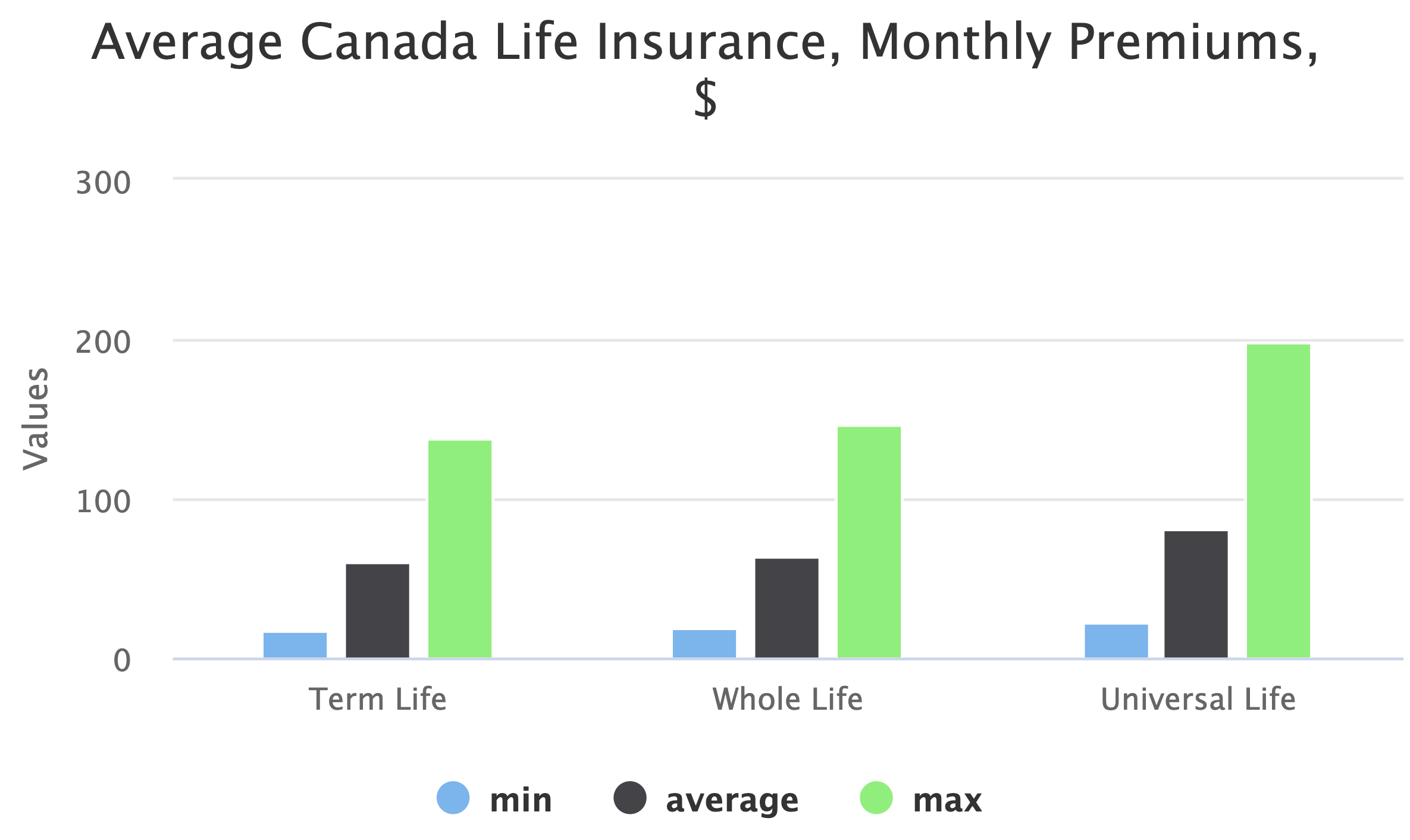

Life Insurance In Bc Best Rates From 25 Insurers

The Dividend Growth Model What Is It And How Do I Use It

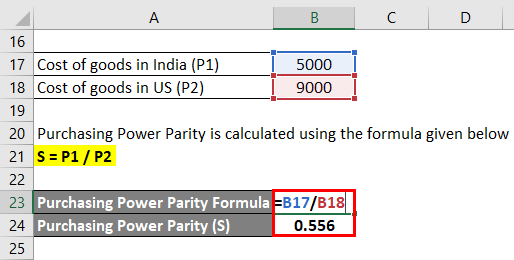

Purchasing Power Parity Formula Calculator Excel Template

Valuation Ratios Springerlink

End Of Qe 4 Fed S Repos Drop Below Oct 2 Level T Bills Balloon Mbs Fall Total Assets Down To Dec 25 Level Wolf Street

What Comes After A Seller Accepts Your Offer Infographic Real Estate Tips Real Estate Infographic Real Estate Marketing

Timeline Powerpoint Infographic Powerpoint Templates Timeline Design Timeline Infographic Design